Webcam models are generally required to pay taxes on their earnings like any other self-employed individual. Tax regulations can vary depending on your country and local jurisdiction, so it’s essential to consult with a tax professional or accountant familiar with the tax laws in your area. They can guide you on correctly reporting and paying taxes on your webcam and modeling income.

webcam models taxes

Here are a few key points to consider regarding taxes as a webcam model:

- Self-Employment Taxes: As a webcam model, you are considered self-employed, which means you are responsible for paying self-employment taxes. Setting aside a portion of your earnings to cover these tax obligations is essential.

- Income Reporting: If you work for a professional webcam studio, they provide a 1099 form at the end of each year showing your exact earnings. Otherwise, you will have to keep track of your earnings.

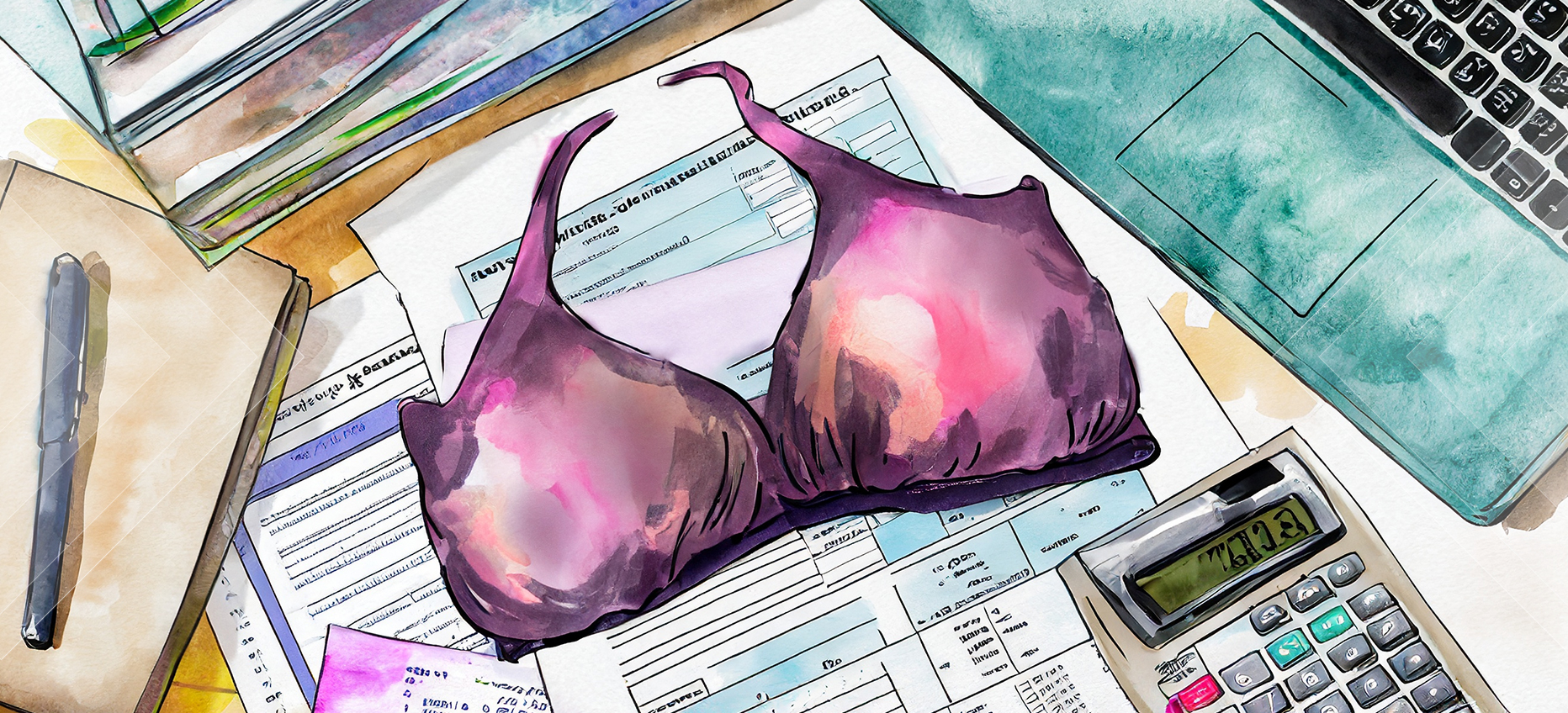

- Deductions and Business Expenses: As a self-employed individual, you may be eligible to claim deductions for legitimate business expenses related to your webcam modeling activities. These include equipment purchases, internet expenses, props, make-up, costumes, promotional materials, and toys. Keeping detailed records and receipts of your business expenses is essential for proper tax deductions. Use a site like mint.com combined with your bank to track and categorize these deductible expenses easily.

- Estimated Quarterly Taxes: Depending on your jurisdiction, you may be required to make estimated quarterly tax payments throughout the year to cover your tax obligations. These payments help you avoid any penalties or interest for underpayment of taxes.

- Always Consult a Tax Professional: Given the complexities of tax laws and regulations, consulting with a tax professional or accountant specializing in self-employment or adult entertainment industries is highly recommended. They can provide personalized advice based on your circumstances and help you meet your tax obligations accurately and efficiently.

Remember, tax laws can change, and it’s essential to stay informed and up to date with any updates or changes that may affect your tax obligations as a webcam model. Working with a qualified tax professional can help you navigate the tax landscape and ensure compliance with the applicable tax laws in your jurisdiction.